Costamare's Bold Spin-Off: Dry Bulk Business Sets Sail as Independent Entity

- Neil Sharma

- 2 days ago

- 5 min read

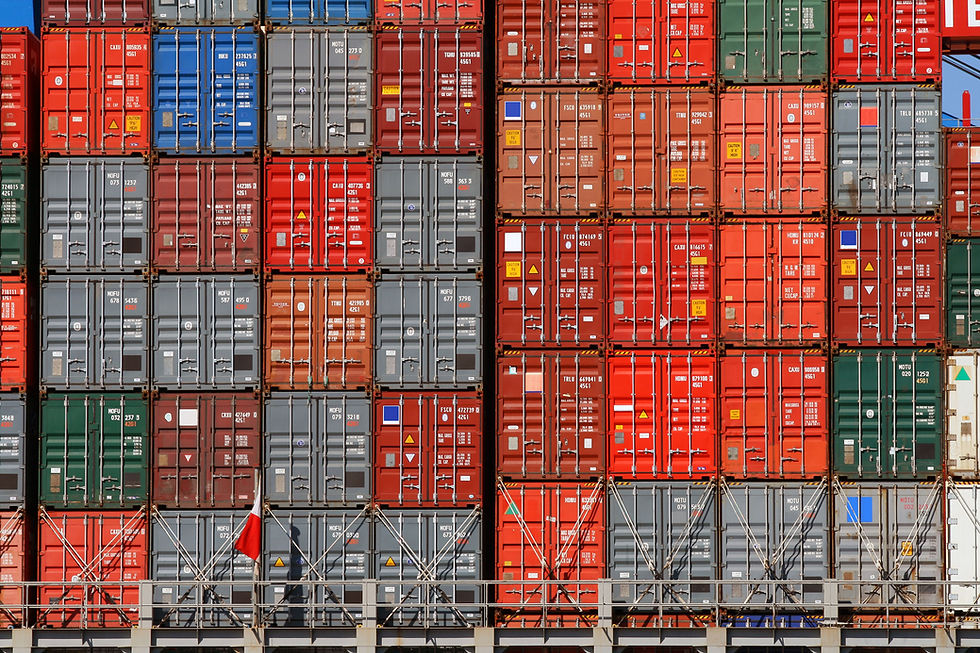

Costamare Inc., founded over five decades ago and known for its extensive containership fleet, is now dividing its operations to create two specialized companies. The goal is to allow both the container and dry bulk businesses to thrive independently under tailored strategies, better suited for their individual markets.

Following the transaction, two companies will trade separately on the New York Stock Exchange: Costamare Inc. (CMRE) and Costamare Bulkers Holdings Limited (CMDB).

Post-Spin-Off Structure: A Closer Look

Let’s break down the assets, operations, and strategic direction of each company post-separation.

1. Costamare Inc. (NYSE: CMRE)

Primary Focus: Container shipping and maritime leasing

Assets and Operations:

68 owned containerships with a combined capacity of approximately 513,000 TEU (Twenty-foot Equivalent Units), placing Costamare among the larger independent containership owners worldwide.

Neptune Maritime Leasing Limited, a subsidiary focused on structured financing solutions and maritime leasing operations, remains part of the core business.

Long-term charters in place with major liner companies, providing revenue visibility and contract stability.

Experienced management team with decades of experience navigating cyclical shipping markets.

Strategic Objectives:

Continue leveraging long-term charter contracts to generate predictable cash flow.

Expand maritime leasing operations to include container and other asset classes.

Maintain a strong dividend policy with a 5.25 percent yield and a 15-year track record of consistent shareholder returns.

2. Costamare Bulkers Holdings Limited (NYSE: CMDB)

Primary Focus: Dry bulk shipping and freight operations

Assets and Operations:

38 owned dry bulk vessels totaling approximately 3.017 million deadweight tons (DWT), including one vessel under contract for sale.

The fleet consists of handysize, supramax, kamsarmax, and panamax vessels, giving the company flexibility in a variety of global trade routes and commodity types.

CBI Platform (Costamare Bulk Infrastructure), an in-house operating platform responsible for:

Chartering vessels in and out based on market demand.

Managing contracts of affreightment (CoAs) with major global commodity traders.

Entering into forward freight agreements (FFAs) to manage freight rate volatility.

Utilizing hedging tools to mitigate risk across interest rate and fuel cost exposures.

Initially focused on owned tonnage, but poised to grow into third-party management or asset-light chartering as part of an opportunistic expansion strategy.

Strategic Objectives:

Establish a solid foothold as a specialized dry bulk carrier.

Leverage CBI’s market presence to scale up freight contracts and grow revenue through diversified shipping operations.

Operate with a lean management structure to maintain cost efficiency and scalability.

The Konstantakopoulos family will retain a 63.1 percent ownership stake in Costamare Bulkers, ensuring alignment with long-term performance and governance continuity.

Spin-Off Timeline: What Investors Need to Know

Here is the sequence of key events that shareholders should track closely:

Date | Event |

April 29, 2025 | Record date for share distribution. “Due-bill” trading of CMRE shares begins, meaning shares trade with the right to receive CMDB shares. |

May 1, 2025 | “When-issued” trading of CMDB shares begins under symbol CMDB WI. “Ex-distribution” trading of CMRE begins under CMRE WI (shares no longer come with CMDB entitlement). |

May 6, 2025 | Distribution occurs: CMDB shares distributed to CMRE shareholders. One share of CMDB per five shares of CMRE. |

May 7, 2025 | CMDB begins full, regular trading under its permanent ticker on the NYSE: CMDB. CMRE continues trading as usual. |

Shareholder Distribution Terms

The spin-off is structured as a pro rata share distribution, meaning existing shareholders receive shares in the new company automatically.

For every five (5) shares of Costamare Inc. (CMRE) held as of April 29, 2025, shareholders will receive one (1) share of Costamare Bulkers (CMDB).

No fractional shares will be issued. Any entitlements to partial shares will be settled in cash.

Strategic Rationale: Why Now?

This spin-off comes at a pivotal time in the shipping industry, where capital discipline, sector specialization, and operational focus are increasingly rewarded by the markets.

Key Benefits:

Independent growth strategies: Each company can now pursue initiatives aligned with its own sector dynamics and investor expectations.

Tailored capital allocation: Distinct balance sheets and operating cash flows provide flexibility in reinvestment and dividend planning.

Clear investment profiles: Investors can now choose between a stable, dividend-oriented container ship lessor and a dynamic, market-driven dry bulk operator.

Operational transparency: Management teams can focus without the distraction of unrelated business lines, improving execution and accountability.

Financial Performance and Outlook

Though the two entities have not yet released separate pro forma financials, some performance indicators are worth noting:

Costamare Inc. continues to benefit from favorable charter renewals, with some contracts secured at rates above market expectations despite recent softening.

The dry bulk market, although cyclical, has seen renewed interest due to global infrastructure demand and shifting supply chains.

Each company will be better positioned to adapt to these unique market conditions post-spin-off.

Broader Industry Context

Spin-offs in the shipping industry are not new. Companies like Navios, Danaos, and Maersk have all executed restructuring strategies in response to market cycles. Historically, well-executed spin-offs have:

Helped unlock value in underappreciated segments

Attracted new types of investors

Led to improved capital efficiency

Costamare’s move is in line with this trend, allowing each unit to target long-term value creation within its sector.

Final Thoughts

Costamare Inc.’s spin-off of its dry bulk segment is more than just a corporate restructuring. It is a strategic step toward unlocking shareholder value, improving operational clarity, and enhancing the long-term potential of both businesses.

Investors now have access to two purpose-built, publicly traded shipping companies, each operating within its own niche and backed by seasoned leadership and proven track records. Whether you’re interested in stable dividends from a container shipping giant or looking to tap into the cyclical upside of dry bulk, Costamare’s transformation offers distinct and focused opportunities.

Stay informed by tracking CMRE and CMDB on the NYSE and reviewing their future earnings calls and investor presentations.

Frequently Asked Questions

Will I still own CMRE shares after the spin-off?Yes. You will continue to own your original shares in Costamare Inc.

Do I have to pay for CMDB shares?

No. CMDB shares will be distributed to you automatically based on your CMRE holdings as of the record date.

Will this affect CMRE’s dividend policy?

Costamare Inc. has committed to maintaining its dividend policy post-spin-off.

How do I know if I qualify for the new shares?

If you own CMRE shares as of April 29, 2025, and hold them through the distribution date, you qualify.

Costamare Spin Off

Costamare Spin Off

Financial Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or legal advice. All opinions expressed are based on publicly available information believed to be accurate at the time of writing. Investing in securities involves risk, and past performance is not indicative of future results. Always consult a licensed financial advisor before making any investment decisions.

Comentários